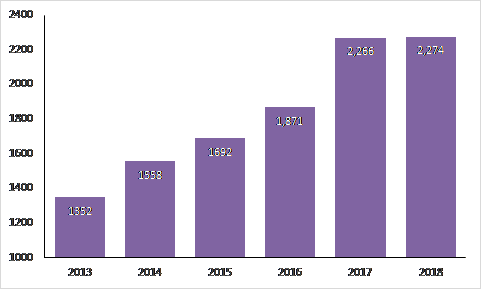

Using data from HMRC, the report found that there were just eight more breweries recorded in 2018 – a massive drop when compared to the 395 recorded in 2017.

The total number of UK breweries reached to 2,274 at the end of 2018, up from 1,352 five years ago

Citing possible reasons for the market having reached this new plateau, James Simmonds, head of drinks at UHY Hacker Young pointed to the massive influx of investment into the sector by multinational brewers who continue to snap up the more successful craft breweries such as the recent acquisition of Beavertown Brewery by Heineken and Lion's purchase of Huddersfield's Magic Rock.

Desperate to get a foot hold in this burgeoning market but unable to do so through their own products, the huge levels of investment that these multinationals can then bring to bear through their “craft” subsidiaries is beginning to throw up barriers of entry against other smaller independent entrants.

These businesses bought by bigger firms can then benefit from their economies of scale, established distribution networks and the ability to negotiate with retailers and pub chains for shelf space, making it harder for newer breweries to compete with them.

James Simmonds stated that the report isn't saying that the market is shrinking just that the number of players is consolidating and sales growth is going to be harder to come by.

“Craft breweries need to ensure their business model is sustainable and profitable at an earlier stage and not just rely on the idea they’ll constantly be able to grow their way out of trouble.

“Multinational breweries can no longer count on the traditional beer market to further expansion. Large corporations will continue to look for new, niche products with high growth potential to fuel their revenue and profits.

“With supermarkets offering limited shelf space and a slow rotation of brands, small craft brewers will need to innovate to break into the market.”